Paying Off Debt: How My Zazzle Business Freed Me From Debt

Today, we’re going to be having a difficult conversation about paying off debt. This is an issue we’re both intimately familiar with, but Elke is going to be sharing her story for now. When you start getting passive income—and a good amount of it—it’s an amazing change, but it’s also a difficult one.

The point of Elke sharing her story today is to help make sure that doesn’t just disappear into thin air. A good example of this is when people end up winning the lottery.

Statistically, a lot of people who win the lottery don’t know how to function with their money. Because of this, they usually lose most of it before too long.

When your Zazzle business takes off, it’s going to be like winning the lottery. When you’re on Zazzle, you’re going to suddenly be making more money than you’ve ever made…well, possibly.

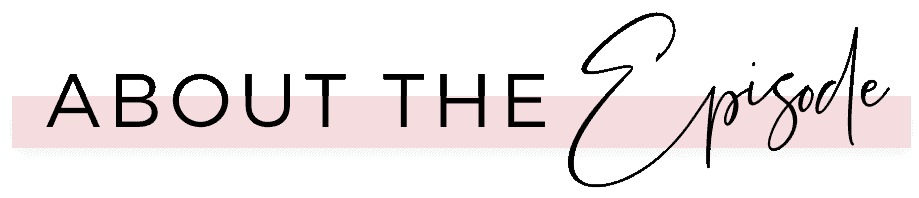

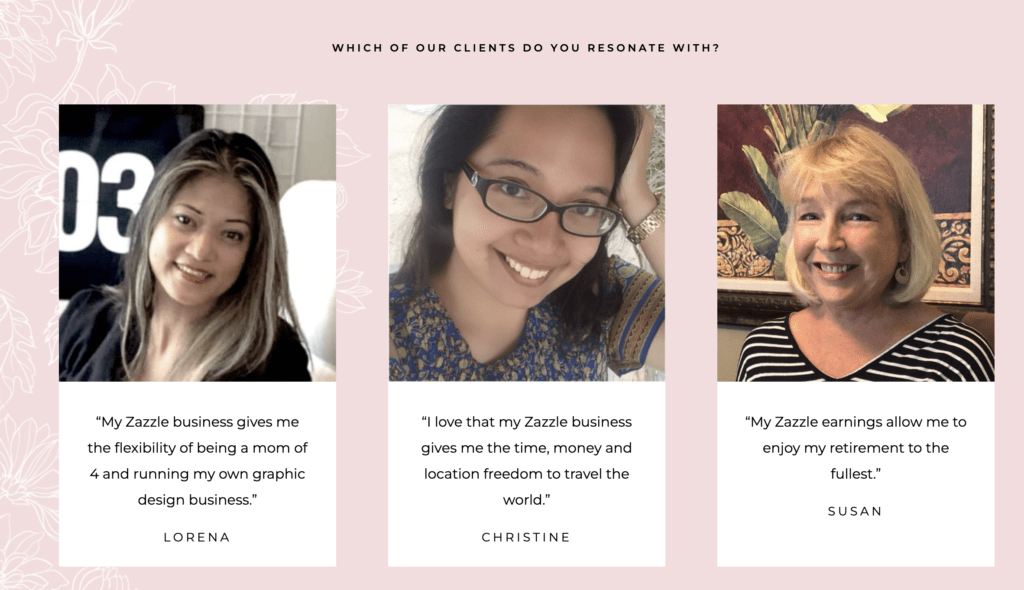

We can’t make any income claims, but we have some clients that are doing really well; all together as a group, they’ve made over 3 million.

So today, Elke is going to be telling you how to save and how to get out of debt. But before we dive right in, let us introduce ourselves in case this is your first visit. Welcome to The Creative and Ambitious Entrepreneur Podcast.

We’re your hosts, Jen and Elke Clarke. We are a mother and daughter team that started Zazzle e-commerce businesses over 10 years ago and have sold over 15 million dollars worth and counting of products on Zazzle.

The Creative and Ambitious Entrepreneur Podcast is for you, the creative. We share actionable steps that you can take to make money in your e-commerce business. In each episode, we will take you one step closer to achieving freedom with your time, location, and finances.

We believe that a profitable e-commerce business is what opens the doors for you to start living your dream life if you work smarter, not harder, use the right tools and follow the proven roadmap. We’re here to give you the tools you need to make your dream life happen. Let’s get started!

The Slow Build

Elke: So the first thing I want to mention before we get into paying off debt is that growth is a slow and steady process, and it hits you quickly.

If you do really well and you start to make more money, it’s better to have a plan on where you’re going to put that money ahead of time. If you wait until you’ve finished earning, you’re going to find it much more difficult to think past the gleeful haze of suddenly having so much money.

Just how slow and steady? Well, when I first started in 2007, I made $90. Then I made $2,300 in 2008. And then all of a sudden I jumped to $37,000, and I thought I’d hit the jackpot because that was pretty much as I made with my first job after having spent 11 years in university to get my doctorate.

I was on the moon; three years of doing creative stuff that I enjoyed almost brought me to what I thought would always be my top salary. I did have a better job at that point, but that first salary that I made after getting out of graduate school was in that range.

In 2010, I made $50,000. So that’s a $12,000 increase from the year before. Then the next year I made a $17,000 increase because I made $67,000. It just kept going up and up and up, and guess what I did?

I took kids on vacations. I spent my money on something other than basic, no-name brand food. I did all the things that were wrong…for me, anyway.

Of course, you can spend your money on those things if you like, but for me, it didn’t go so well. I kept not paying off my debt. But in 2012, I started making $100,000, and I finally realized it was time to get responsible about this.

I didn’t see any change in my earnings projections, so it was time to get to work paying off debt. But then, unfortunately, my husband passed away.

The Pause

As we’ve mentioned in other episodes, our whole world just shut down for a while when my husband passed. Paying off debt was the last thing on my mind.

We couldn’t even open our computers, we were so depressed. He wasn’t meant to pass away so young, and it really took us for a loop.

I don’t talk about it very often, but I want to be honest about it here so you understand why Zazzle has been so important through this tragedy. It left me with three children and no other source of income except for my own.

So when it came to paying off debt, my Zazzle business was my only income, and I needed to figure out how to use it wisely—not only to start paying off debt but to build wealth and a future for myself, knowing that there was a whole other side of my family that was no longer earning money to support what we had set up.

Engage, LEARN, IMPLEMENT

How I Ended Up Paying Off Debt…And You Can, Too!

Now that I’ve talked about what led me to realize I needed to get serious about paying off debts, let’s talk about the tricks I discovered along the way.

Taxes

The first thing to remember before working toward paying off debt is that when Zazzle money comes in, you have to pay taxes on it. They don’t take it out for you. So you’ll immediately want to calculate how much you have to pay in taxes. Put that aside—that’s utterly untouchable because you don’t want to get into that kind of debt.

Rainy Day Fund

The next thing you should do when working towards paying off debt is put some money into a rainy day fund. That fund doesn’t have to be there right away, but you will want to build it up over a few months once you start making more money.

Why do you need this? Because what happens if you can’t work for a little bit and something happens with your earnings?

You want to be able to regroup without worrying about suffering financially. In order to do that, you’ll want to check to see how much you usually spend in a month, multiply that by six, and figure out how you can start saving that amount. This will keep you from having to worry about paying off debt accumulated while you aren’t working.

Monthly Expenses and Fun Money

The next part, obviously, is to make sure you can function each month while paying off debt. On top of that, once you’ve set up your monthly budget, if there’s anything left over, give yourself a certain amount of “fun money” so that you can do something fun—after all, you earned it! You’re being super responsible, and in addition, this will lessen the temptation to spend money from your other categories on things you don’t need while you’re paying off debt.

Pay Off Credit Cards First

Remember: when paying off debt, start paying that off credit cards first because those have the highest interest rate. If you can only pay the monthly fee for now, plan to try and build that payment up gradually. When you only pay the monthly amount, you’re always getting charged more and more interest, and it just snowballs until you really get stuck.

Start Paying Off Debt Today!

So that’s the idea! Get yourself out of debt, get yourself a rainy day fund, and make sure that you are also giving yourself a little bit of fun money so that you can enjoy life while you’re being so responsible. Paying off debt is your first step to total financial freedom!

Are you ready to turn your Zazzle hobby into a proper e-commerce business? The Profit by Design Academy® Coaching Program is what you need! Get the proper roadmap and hands-on support to accelerate your Zazzle business and make your dream of achieving passive income a reality!

Have you already built a successful 6-figure Zazzle business, but can’t seem to break through the ceiling to 7 figures? If you’ve sold 100K worth of your Zazzle products and want to sell 10X more, take a look at our 7 Figure Seller Mastermind!

Join The Creative and Ambitious Entrepreneur FB Community

Join to be supported by like-minded entrepreneurs in this thriving community.

Inside our free Creative and Ambitious Entrepreneur FB Community, you’ll find like-minded, inspiring, motivating, and supportive business babes who are ready to thrive in the online creative e-commerce world.

Let’s Be Instagram Besties

Be part of our thriving and supportive community and follow Elke and I on Instagram. Find out the latest happenings. Connect. Let’s DM and chat on IG @msjenclarke and @elkeclarke.

About your hosts

Jen and Elke Clarke are a mother-daughter duo that empowers women entrepreneurs to make money online. Through courses and coaching, Jen and Elke help women (and men) become successful creative entrepreneurs on Zazzle and e-commerce. Combined Jen and Elke have sold over 15 million dollars-worth of products, and earned over $1.5 million combined through their businesses on Zazzle. Jen and Elke have influenced and transformed the lives of hundreds of thousands of people worldwide with their free content, paid and private coaching.

They are international, award-winning authors. Click the links to purchase their books through Amazon: Earn Around The World and Create Online and Grow Rich.

Jen and Elke Clarke have been featured in Yahoo Finance as TOP 5 e-commerce coaches.

FEATURED ON